State of house There are vast variations in vehicle insurance policy costs for 16-year-olds from one state to one more. For instance, for a 16-year-old woman, the costs can vary from a low of $1,547 per year in Hawaii, to a high of $14,533 in Michigan - trucks. For a 16-year-old man, the costs can range from a reduced of $1,547 in Hawaii, to a high of $14,691 in Michigan (cheaper cars).

A lot of states, nevertheless, have also lower legal coverage restrictions - low-cost auto insurance. As an example, the minimum in your state might be 25/50/25, though this differs with each of the 50 states. Based on the national standard of state-mandated minimum coverage levels, the average national costs for automobile insurance policy policies for 16-year-olds drops to $2,593 (low cost).

While Progressive has an average yearly premium of $1,430 for a 16-year-old man added to a moms and dad policy, Allstate charges $5,005 for the very same protection. The scenario is similar with a 16-year-old lady added to a moms and dad plan. The ordinary annual costs for a plan from Progressive is $989 per year, while State Ranch charges $3,022 for the very same insurance coverage. dui.

Precisely which companies will have the lowest premiums will depend on your state of home. Available discount rates Basically every insurance firm supplies discount rates for vehicle insurance coverage.

Why it's so a lot more pricey for 16-year old drivers Vehicle insurance for 16-year-olds is so pricey due to the risks these motorists existing to cars and truck insurance policy business - insured car. Those risks equate into higher prices to pay claims, which translates into greater premiums (low cost auto). It's unfavorable that an or else accountable 16-year-old will certainly be billed a greater premium based on threat aspects she or he might never show.

The Buzz on How Much Does Car Insurance Cost For A 16 Year Old?

That's where a 16-year-old will be released a limited certificate, that will gradually be upgraded to an unrestricted, or complete permit, at a later age., with the full understanding that any kind of violation can cause either a much greater cars and truck insurance costs, or even certificate The original source suspension - low cost auto. Instances: Arizona In Arizona, 16-year-old vehicle drivers obtain an intermediate permit, after which they are not able to drive in between the hrs of twelve o'clock at night and also 5:00 AM. cheaper.

vehicle cheaper auto insurance cheap insurance insurance companies

vehicle cheaper auto insurance cheap insurance insurance companies

There are additionally particular policies that use depending on where in the state you live. An unlimited license is offered by age 18, or at 17, after finishing a state-certified motorist education and learning program. dui. How to Conserve on Cars And Truck Insurance Coverage for 16-Year-Olds You can reduce the price of automobile insurance coverage for 16-year-olds by: keeping reduced degrees of coverage having a car that's much less expensive to insure making an application with the lowest-cost insurance business in your area capitalizing on every discount they supply However there's an even larger means to reduce car insurance coverage for 16-year-olds that will easily outweigh all those efforts incorporated.

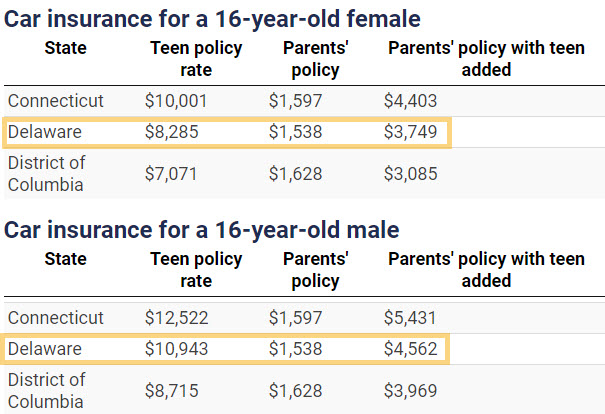

Including a teenager chauffeur to an existing policy The premium on the parent's policy will still increase, however it will certainly be much reduced than the expense of carrying a moms and dad plan as well as a standalone teen policy - business insurance. You may also have the ability to obtain more price cuts by adding an added driver and an additional vehicle to the policy.

Nevertheless, that may not be feasible if the moms and dad's need to preserve full insurance coverage, given that the cars and truck insurance provider will be unlikely to have different obligation restrictions within the same plan. Including the teen to the moms and dad's policy is the option most parents select, considering that the expense of taking a separate plan on a young adult will be entirely expensive for the average house.

When it involves teen motorists and auto insurance, points obtain complex-- and pricey-- swiftly. A moms and dad adding a male teen to a plan can expect automobile insurance coverage rate to swell to even more than $3,000 for complete coverage - vehicle insurance. It's also higher if the teen has his own plan.

The 2-Minute Rule for Teens Who Get A Driver's License At 16 Will Cost Their ...

car insurance accident insurance company credit score

car insurance accident insurance company credit score

Currently, that we've examined those serious facts, allow's guide you through your vehicle insurance policy acquiring. We'll take a look at discount rates, alternatives and also special situations-- so you can discover the ideal car insurance for teens. Despite the fact that the best answer is typically to add a teen onto your plan to mitigate several of the cost, there are various other options and also price cuts that can save cash.

In the long run, you'll require to contrast auto insurance quotes using our quote comparison tool to see which firm is best for you. Trick TAKEAWAYSAccording to the federal Centers for Condition Control as well as Avoidance, the most awful age for accidents is 16. If the trainee plans to leave a cars and truck in the house and the university is greater than 100 miles away, the university student might get approved for a "resident student" discount or a trainee "away" discount.

This is called a named exclusion. IN THIS ARTICLEHow much is car insurance coverage for teenagers? Like we've stated, teen auto insurance coverage is pricey. The more youthful the vehicle driver, the much more expensive the car insurance coverage. Youthful motorists are much more most likely to enter into automobile crashes than older chauffeurs. The danger is highest possible with 16-year-olds, who have a crash rate two times as high as 18- and 19-year-olds.

affordable auto insurance cheaper cars cars laws

affordable auto insurance cheaper cars cars laws

A research study by the IIHS located states with stronger graduated licensing programs had a 30% reduced deadly crash price for 15- to 17-year olds. Adding a teenager to your auto insurance coverage policy, Adding a teenager to your automobile insurance plan is the cheapest way to get your teen guaranteed (credit). It still includes a large price, however you can definitely save if you pick the best automobile insurance provider for teenagers.

After that we added a 16-year old teenager to the plan. Below's what took place: The average home's cars and truck insurance costs increased 152%. An adolescent boy was a lot more pricey. The ordinary expense rose 176%, contrasted with 129% for teen ladies. California rates enhanced one of the most, more than 200%. The reason behind the walks: Teenagers crash at a much greater price than older vehicle drivers.

The Main Principles Of Car Insurance Guide For California Teens - Driversed.com

cheaper car insurance cheap car insurance prices

cheaper car insurance cheap car insurance prices

According to the government Centers for Disease Control and Avoidance, the most awful age for mishaps is 16. They have an accident rate twice as high as chauffeurs that are 18- as well as 19-year-olds. Prices differ by insurance provider, which is the factor we suggest looking for teen vehicle driver insurance. It's simple to switch automobile insurance coverage firms - trucks.

Simply see to it your teenager isn't driving on a complete certificate without being formally included in your plan or their own (insurance companies). That would certainly be risky. If my teen gets a ticket, will it elevate my rates?. When with each other on the very same plan, all driving documents-- including your teenager's-- affect premiums, for better or even worse.

To comprehend exactly how a moving offense will certainly impact your prices, we ran a study and found that the extra cost might run from 5% to as high as 20%. Can a teen get their own cars and truck insurance plan? Firms will certainly market directly to teenagers. affordable. Nevertheless, state legislations vary when it comes to a teenager's capacity to sign for insurance.